Transform your home buying process into a successful investment with data-driven insights

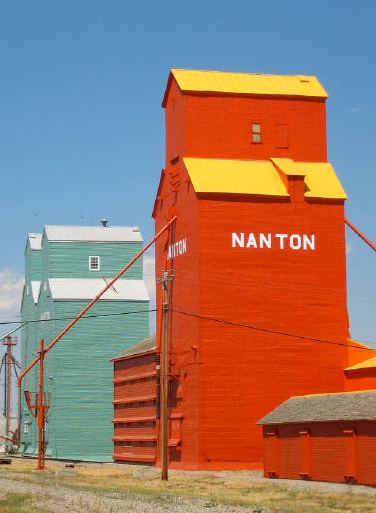

Buying a home represents one of life's most significant financial decisions. With 40+ years of combined experience and 1,300+ successful transactions across High River, Okotoks, and Southern Alberta, we deliver strategic guidance that transforms complex market conditions into clear opportunities.

The home buying process | Your roadmap to success

Let's discuss your goals

We begin every client relationship with comprehensive market intelligence. Over coffee at local favorites like Colossis, we'll explore your lifestyle goals, investment timeline, and strategic positioning preferences.

What we'll cover:

- Market timing analysis with current trend insights

- Neighborhood strategy matching your lifestyle and investment goals

- Budget optimization with strategic financing guidance

- Investment potential assessment across target areas

Strategic advantage: Understanding market cycles and timing can save you $10,000-$30,000 on your purchase.

Home buying checklist | Strategic preparation guide

While home buying involves numerous moving parts, our partnership ensures nothing falls through the cracks. This comprehensive checklist outlines your responsibilities alongside our strategic expertise. As your real estate advisors, we handle the complex market analysis, negotiation tactics, legal coordination, and transaction management while you focus on the personal decisions that shape your future home.

✅ PRE-SEARCH PREPARATION

Credit score optimization (Aim for 650+ for best rates)

Down payment strategy (Minimum 5%, optimal 20%+)

Pre-approval completion (We can coordinate with strategic lender selection)

Market research (We provide comprehensive neighborhood analysis)

Strategic timeline (We develop with key milestone dates)

✅ PROPERTY EVALUATION CRITERIA

Location analysis (We provide growth potential, amenities, transportation insights)

Property condition assessment (We coordinate professional inspections and analysis if needed)

Market value verification (We can deliver detailed comparative market analysis)

Investment potential evaluation (We provide ROI forecasting and trend analysis if needed)

Lifestyle fit assessment (Space, layout, community preferences)

✅ OFFER & NEGOTIATION PREPARATION

Market positioning research (We handle all strategic seller motivation analysis)

Financing confirmation (Rate hold and approval documentation)

Inspection contingency planning (We coordinate with qualified professional contacts)

Legal representation arrangement (We connect you with our preferred legal network if preferred)

Insurance quotes (Budget confirmation and coverage)

✅ CLOSING PREPARATION

Final walkthrough scheduling (We coordinate and attend with you)

Utility transfer arrangements (Connection scheduling)

Moving coordination (Timeline and logistics planning)

Address change notifications (All accounts and services)

Warranty registration (Appliances and home systems if applicable)

Strategic home buying tips | Expert insights for success

Ready to make your strategic move?

Start with a complimentary consultation.

Market analysis for your specific property goals

Strategic timing guidance for optimal outcomes

Negotiation strategy session tailored to your situation

Investment potential assessment with trend forecasting

Why work with us?

🎯 Strategic negotiation expertise

📊 Data-driven local market intelligence

🏘️ Deep local market mastery

🤝 Professional partnership advantage

🌐 Century 21 global resources

⭐ 5 star reviews and 750+ satisfied local clients

Contact us today to get started.